ETON

signifies tradition, integrity and commitment to service

HURST

symbolizes resilience and commitment to achieve excellence

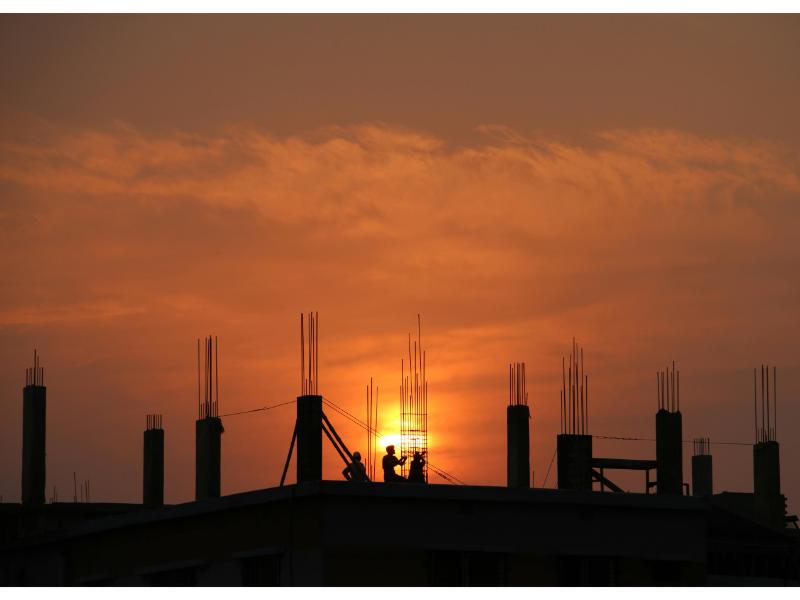

Founded in 2022 by industry veteran Bamasish Paul and Tushar Bose, Etonhurst Investment Advisors is a Mumbai based real estate fund management platform focused on India. With nearly 40 years of collective experience, our founders navigate the complexities of real estate investments with unparalleled expertise and unwavering commitment to excellence.

Our Funds

Etonhurst Redevelopment Opportunities Fund I

Etonhurst Real Estate Opportunities Fund launched its maiden fund - the Etonhurst Redevelopment Opportunities Fund I. This innovative fund aims to unlock value in Mumbai’s thriving residential redevelopment market, offering investors a unique opportunity to participate in a highly lucrative and largely untapped segment of the real estate sector

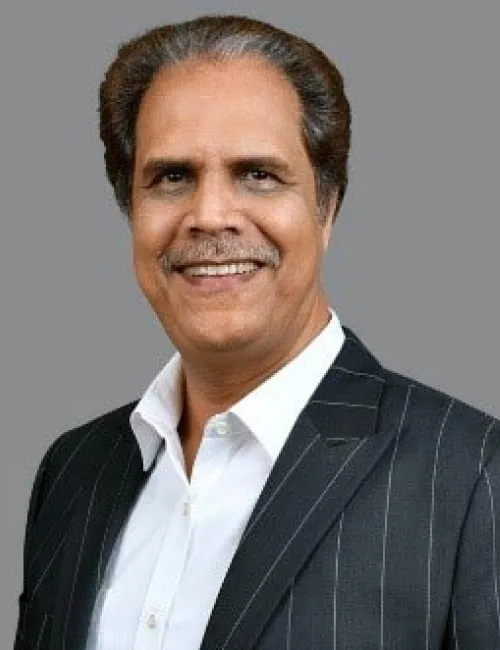

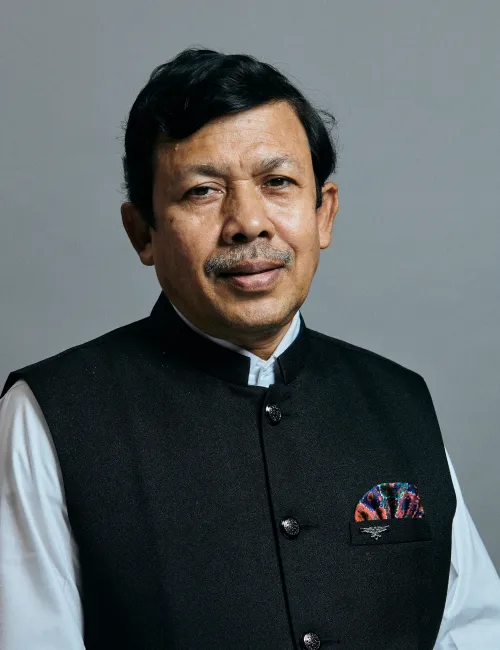

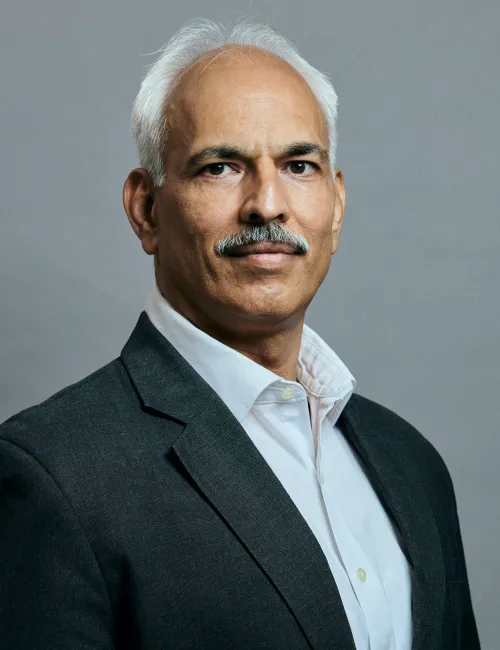

Founders

With over 24 years of experience in real estate fund & asset management, he has invested over INR 10,000 crore (US$1.2 billion) across various real estate asset classes in India…

With 15 years of experience, he leads fundraising and the firm’s operations, business development and strategic initiatives. He brings a wealth of experience in real estate financing and private equity…

With 30+ years of experience in law and real estate, Surender has held senior leadership roles across some of India’s largest developers. He was formerly Chief Legal & Compliance Officer at Godrej Properties…

Darshan brings 25+ years of experience in real estate, private equity, and fundraising. He was previously Head of Fund Raising at First Eagle Real Estate Fund, a Delta Corp entity, and has also worked at Peninsula…

With 15+ years in private equity and real estate investment, Rahul has held senior roles at Edelweiss Alternatives and Nippon, focusing on real estate credit investments. He has a strong track record in portfolio…

Meghal brings 5+ years of experience in real estate deals and fund analysis, having worked as an Analyst at Cheyne Capital in London and Madrid, specializing in real estate credit deals. He also contributed to…

Saamarthya brings 5+ years of experience in technology consulting and project leadership. He has led cross-functional teams and managed key client relationships….

Nivedita brings over 11 years of experience in real estate, having worked with organizations such as Adhiraj, Today Global, and Siemens. Her expertise includes office administration, vendor negotiations…

Get In Touch

We welcome the opportunity to interact with you. Our team of experts are ready to provide you with detailed information about our funds, investment strategies and market insights. Please feel free to reach out to us.