About Us

Home » About Us

Etonhurst’s Investment Philosophy is based on the Arthashastra (अर्थशास्त्र),

an ancient Indian Sanskrit treatise, which states :

Quality of a person, character and knowledge are prime requirements for wealth creation.

People

Our people are the core of our business. We foster a culture of innovation, encourage open dialogue, and empower our team to ask critical questions, driving continuous growth and curiosity.

Character

Unquestionably, integrity is our most valuable asset. We uphold the highest ethical standards and have zero tolerance for unethical practices, ensuring we always adhere to our ethical code.

Knowledge

Knowledge is the foundation of risk management. At Etonhurst, we seek valuable insights through ground research and market interactions to effectively assess and mitigate risks.

Founded in 2022 by industry veteran Bamasish Paul and Tushar Bose, Etonhurst Investment Advisors is a Mumbai-based real estate fund management platform focused on the Indian market. With nearly 40 years of collective experience, our founders navigate the complexities of real estate investments with unparalleled expertise and unwavering commitment to excellence.

The name “Etonhurst” encapsulates our core values :

ETON

signifies tradition, integrity and commitment to service

HURST

symbolizes resilience and commitment to achieve excellence

Navigating India’s dynamic real estate landscape with precision, integrity and deep insight. Etonhurst delivers superior risk-adjusted returns through meticulous research, ethical practices, and unparalleled market expertise.

Deep Expertise

Our founders and senior management bring deep experience gained through multiple market cycles, offering valuable insights into India’s ever-evolving and dynamic real estate landscape.

Proven Track Record

Our team has executed and advised on 100+ transactions across all real estate asset classes at leading global and domestic firms, with a strong history of delivering superior returns through successful exits.

Team Experience

Leveraging over 150 years of collective experience, our skilled team of fund managers identifies and capitalizes on opportunities driving India’s real estate transformation.

Strong Relationships

Leveraging the extensive network of our founders and management team, we secure exceptional deal-sourcing opportunities, giving us a significant competitive edge in the market.

Our mission is to consistently exceed investors' expectations without compromising on our core values of risk management, business ethics and integrity.

Our Philosophy

At Etonhurst, we believe that true wealth creation stems from consistent, risk-adjusted returns rather than volatile, unpredictable outcomes. Our investment approach is rooted in thorough research, meticulous due diligence and a commitment to the highest ethical standards.

We prioritize long-term value creation over short-term gains, always keeping the interests of our stakeholders at the forefront of our decision-making process. By leveraging our on-ground experience and qualitative insights, we seek out market inefficiencies to generate superior risk-adjusted returns for our investors.

Risk Management

We focus on the proactive identification and mitigation of potential risks, ensuring stability and safeguarding our investments against disruptions that may arise in both the market and broader environment.

Ethical Standards

Upholding the highest ethical standards is absolutely non-negotiable. We remain absolutely committed to maintaining 100% integrity in all aspects, ensuring transparency and accountability at every level.

Transparency

We build lasting trust through transparency, fostering open communication and ensuring a steady flow of information between Etonhurst, our dedicated team, and all our relevant stakeholders and partners.

Long-Term Relationships

We focus on cultivating and maintaining long-term relationships with our investors, partners, and team members, prioritizing sustained success and meaningful connections over any short-term financial gains or outcomes.

We have an innovative and flexible investment structure to protect the downside risk, while benefitting from market linked upside. Our investment process is based on 3 fundamental principles.

Source The Best

-

Access to exclusive off-market deals, ensuring unique investment opportunities

-

Long-standing relationships with trusted developers built over decades

-

Strategic market coverage to identify high-growth assets with strong upside potential

Execute Intelligently

-

Each investment is rigorously evaluated through our proprietary framework

-

A thorough due-diligence process to assess risk and safeguard returns

-

Adherence to global private equity standards to maximize efficiency and success

Exit Successfully

-

Hands-on project management to ensure timely execution and value delivery

-

Robust asset management to control costs and meet project timelines

-

Active monitoring of investments to maximize upside potential while mitigating risks

If you want to walk fast, walk alone. But if you want to walk far, walk together"

- Late Shri Ratan Tata

At Etonhurst, we believe that our team is the bedrock of our success. We foster an environment of collaboration, innovation and mutual respect, where each member contributes their unique expertise to achieve our collective goals. Our diverse team brings together a wealth of experience from various facets of the real estate and investment.

Founders

With over 24 years of experience in real estate fund & asset management, he has invested over INR 10,000 crore (US$1.2 billion) across various real estate asset classes in India…

With 15 years of experience, he leads fundraising and the firm’s operations, business development and strategic initiatives. He brings a wealth of experience in real estate financing and private equity…

Team

With 30+ years of experience in law and real estate, Surender has held senior leadership roles across some of India’s largest developers. He was formerly Chief Legal & Compliance Officer at Godrej Properties…

Darshan brings 25+ years of experience in real estate, private equity, and fundraising. He was previously Head of Fund Raising at First Eagle Real Estate Fund, a Delta Corp entity, and has also worked at Peninsula…

With 15+ years in private equity and real estate investment, Rahul has held senior roles at Edelweiss Alternatives and Nippon, focusing on real estate credit investments. He has a strong track record in portfolio…

Meghal brings 5+ years of experience in real estate deals and fund analysis, having worked as an Analyst at Cheyne Capital in London and Madrid, specializing in real estate credit deals. He also contributed to…

Saamarthya brings 5+ years of experience in technology consulting and project leadership. He has led cross-functional teams and managed key client relationships….

Nivedita brings over 11 years of experience in real estate, having worked with organizations such as Adhiraj, Today Global, and Siemens. Her expertise includes office administration, vendor negotiations…

Santosh More

IT & Administration

Gaur Das

Office Assistant

Investment Committee

Etonhurst’s Investment Committee brings together some of the most prominent names in private equity and real estate in India. With over 80 years of collective real estate experience, our IC combines global best practices with deep local market knowledge to ensure rigorous evaluation and strategic decision-making for all our investments.

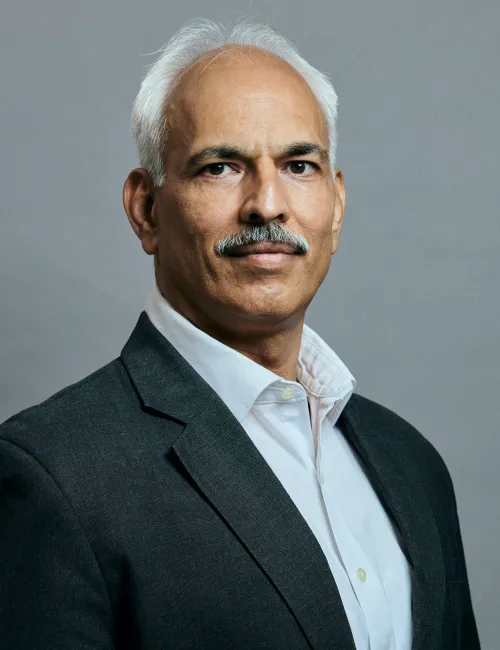

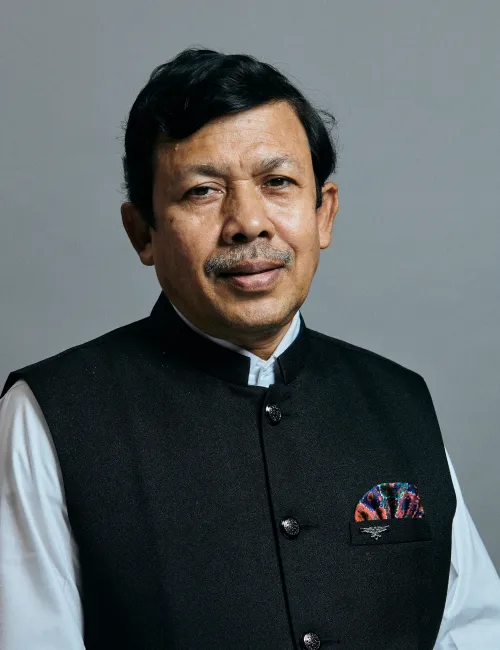

With over 24 years of experience in real estate fund & asset management, he has invested over INR 10,000 crore (US$1.2 billion) across various real estate asset classes in India…

Chairman of The Guardians Real Estate Advisory, Kaushal brings over 35 years of experience in facilitating large-scale land transactions and joint ventures across Mumbai Metropolitan Region….

Pravin Ajmera is a veteran in the real estate industry with over 25 years of experience in investing, business development, global corporate governance, land transactions and advisory….

Sponsors

Our sponsor partners bring invaluable industry expertise and strategic insights to Etonhurst, enhancing our ability to identify and capitalize on prime investment opportunities in the Indian real estate market. Their deep network and years of experience provide us with a significant competitive advantage.

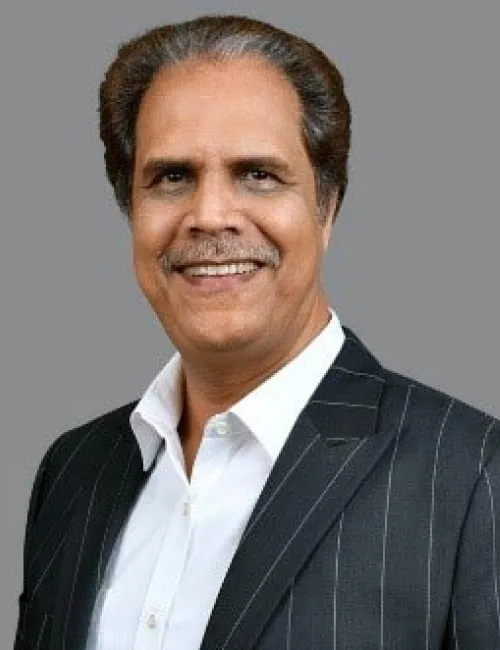

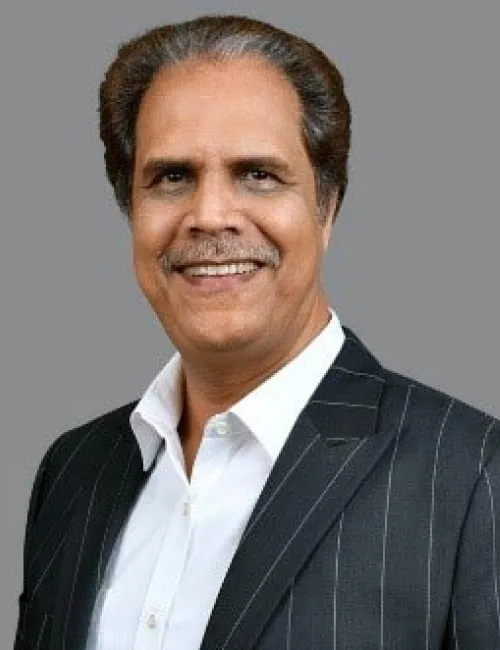

Managing Director of The Guardians Real Estate Advisory, Khetsi has over 23 years of experience in the real estate sector. His unparalleled relationships with developers and keen business acumen contribute…

Chairman of The Guardians Real Estate Advisory, Kaushal brings over 35 years of experience in facilitating large-scale land transactions and joint ventures across Mumbai Metropolitan Region….

Memoriam

Udayan Bose

Udayan Bose was a pioneering investment banker and a foundational figure in shaping India’s modern financial services industry over a remarkable career spanning nearly five decades…